Implementing ESG practices are becoming a crucial focus for many businesses. However, a comprehensive understanding of ESG practices and the appropriate reporting frameworks companies can use to measure long-term ESG strategies is still a common concern. Therefore, Vu Phong Energy Group has prepared this article to help address some of these questions.

Overview of ESG and reporting frameworks

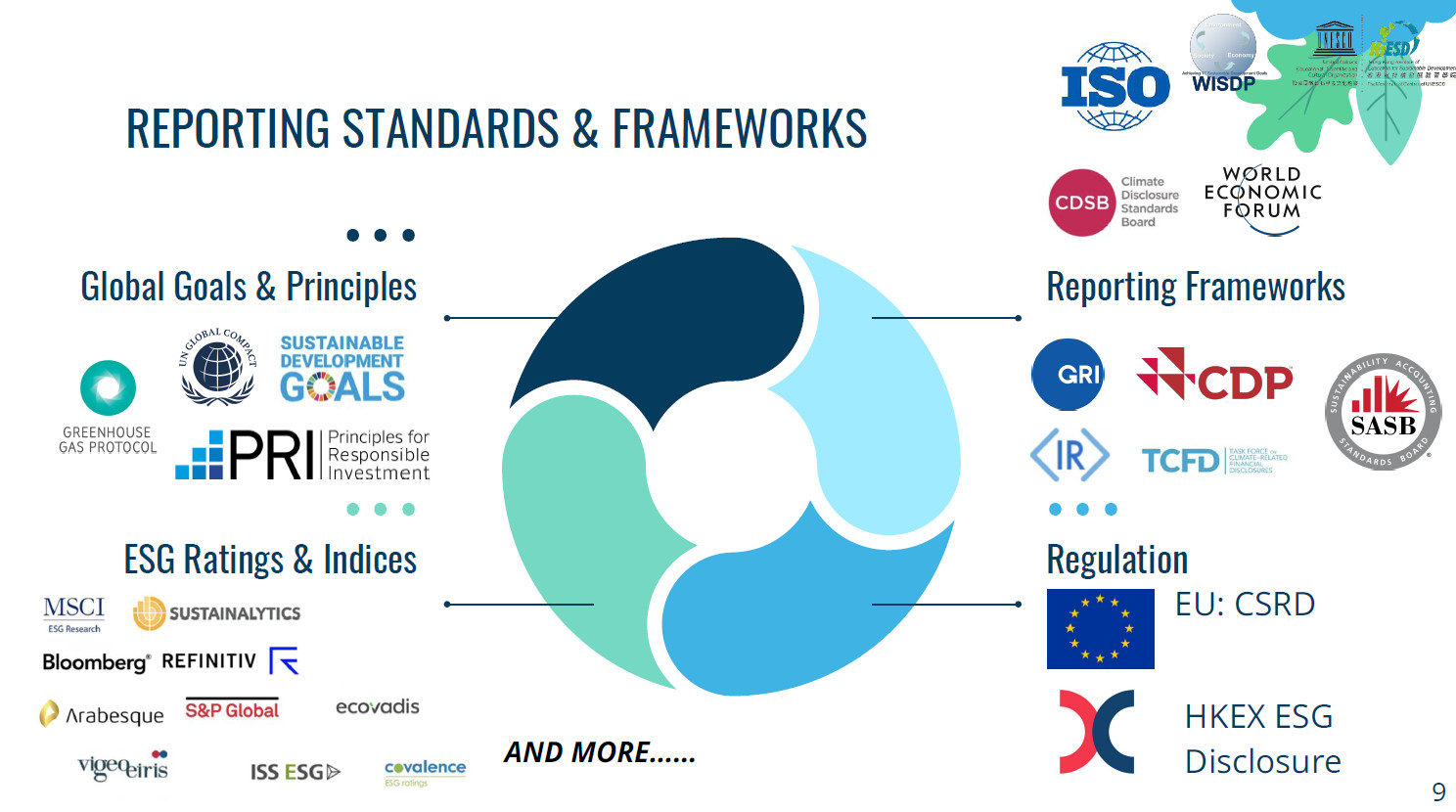

ESG stands for Environmental, Social, and Governance. These are sets of standards for measuring a company’s sustainability and societal impact. Companies can reference several global reporting frameworks, including the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC), and the Sustainability Accounting Standards Board (SASB). The choice of framework depends on the company’s context and the specific aspects they needs to focus on.

For example, GRI – the most widely used ESG framework in global sustainability reports, with over 160 policies in more than 60 countries requiring GRI – focuses on the impact of a company on economic, environmental, and human aspects, including human rights. This framework includes three universal standards and 34 detailed topics.

Key ESG reporting standards and frameworks (Source: Udemy)

Key ESG reporting standards and frameworks (Source: Udemy)

Why ESG matters for businesses

Implementing ESG standards not only broadens market opportunities for businesses but also enhances their reputation and mitigates legal, financial, and reputational risks. ESG enables companies to explore new opportunities and positively impact society and the environment, thereby fostering sustainable relationships with stakeholders.

- Broaden market opportunities: Businesses that excel in ESG practices tend to attract more customers and investors interested in sustainable development.

- Enhance reputation: Following ESG standards demonstrates a company’s social and environmental responsibility commitment.

- Mitigate risks: Transparency and strict compliance with ESG standards help businesses avoid many legal and financial risks.

For example, FedEx decided to convert 20% of its fleet to electric or hybrid engines, becoming more sustainable and saving on fuel costs. By 2020, FedEx achieved this 20% goal, reducing fuel consumption by over 50 million gallons. Similarly, 3M has long recognized that proactively managing environmental risks can provide a competitive advantage. Through its “Pollution Prevention Pays” (3Ps) program, 3M has saved $2.2 billion since 1975 by preventing pollution through product improvements, process enhancements, equipment redesign, and recycling and reusing production waste.

Recently, ESG strategies have evolved from being a must-have in business development plans. With rapidly evolving global policies and regulations, governments are enacting policies to ensure that businesses aiming to enter their markets must implement sustainable solutions based on the three ESG pillars. For instance, the EU has introduced the Corporate Sustainability Reporting Directive (CSRD), which requires all large companies and all publicly listed companies in the EU (excluding micro-enterprises) to disclose information about risks and opportunities arising from social and environmental issues, as well as the impact of their activities on people and the environment.

ESG reporting global progress (Source: Udemy)

ESG reporting global progress (Source: Udemy)

Implementing ESG step-by-step in businesses

Currently, many businesses in Vietnam engage in spontaneous CSR activities and do not focus on long-term ESG strategies. The measurement and data management systems for ESG reporting in these companies are often limited and inconsistent with international standards. Therefore, to practice long-term ESG, businesses must gradually build a measurement and management system based on the international reporting frameworks mentioned earlier.

The implementation of ESG in businesses should be a step-by-step process, tailored to each company’s capabilities and context. Companies may consider starting with the “Environmental” aspect. For instance, internal solutions like reducing single-use plastic waste or adopting solar power to transition towards green energy can help reduce Scope 2 emissions and work towards Net-Zero over time. Environmental solutions are often transparent and easy to measure. Policies such as the Carbon Border Adjustment Mechanism (CBAM) and the Clean Competition Act make the green transition even more critical for businesses exporting goods to international markets.

For example, the Vietnam Beverage Factory – Vinamilk factory in Binh Duong achieved carbon neutrality for Scope 1 and 2 emissions in 2022. The rooftop solar power project at the factory, with a capacity of 1MWp implemented by Vu Phong Energy Group, contributed significantly to emission reductions.

Solar power at Vietnam Beverage Factory, installed by Vu Phong Energy Group

Solar power at Vietnam Beverage Factory, installed by Vu Phong Energy Group

The next journey

Practicing ESG and standardizing actions based on frameworks like GRI and CDP is set to become an indispensable trend. Alongside implementing renewable energy systems—crucial for reducing greenhouse gas emissions in the “Environmental” aspect—specific other solutions are also necessary for sustainable development.

Companies with high emissions, listed in Decision 01/2022/QD-TTg, will focus on measurable and transparent “Environmental” activities, such as optimizing energy use, waste treatment, or using financial tools like carbon credit trading and emission quota offsets. This follows the requirements of Decree 06/2022/ND-CP on greenhouse gas emission reduction and ozone layer protection.

Other companies not on the list can choose how to implement ESG based on their capabilities, balancing benefits and costs. They can start with simpler actions, such as ensuring employee rights, gender balance policies, and promoting training and career opportunities for women, people with disabilities, and marginalized communities. This not only enhances the company’s public reputation but also creates a positive and attractive working environment for employees. Implementing ESG measures brings business benefits and contributes to the sustainable development of society and the environment. This is the path every company needs to follow in the future.

Therefore, as a reliable partner for businesses on the journey to renewable energy, Vu Phong Energy Group and our member companies will continue to accompany businesses in promoting green initiatives, aiming for Net-Zero according to a suitable roadmap for each organization.

Specifically, VP Carbon (a member of Vu Phong Energy Group) will provide consultation on Net-Zero roadmaps, offer Net-Zero solutions, and facilitate the registration and trading of energy certificates (I-RECs) and carbon credits (CERs). All these efforts aim to minimize environmental impact and create a sustainable future for businesses and society.

Vu Phong Energy Group